The Future of Market Infrastructure for ETD

Collaborating with the global finance industry to solve the most pressing operational and technological challenges in Exchange Traded Derivatives

Recent News

London/Chicago

January 15, 2026

London/Chicago

November 11, 2025

London/Chicago

September 17, 2025

London/Chicago

April 1, 2025

London/Chicago

March 11, 2025

Why Choose Us

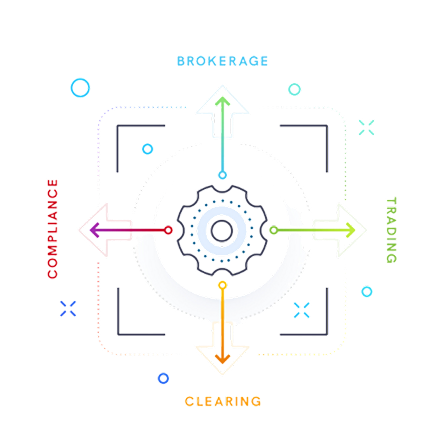

Removing frictions in

brokerage, trading, clearing, and compliance

Our vendor inter-operable, cloud based systems solve the most pressing operational and technological challenges for participants, including buyside firms, end users, FCMs, introducing brokers & market makers.

Used by over 8,000

market participants

We support a complete trade lifecycle for all market participants, from counterparty on-boarding through post-clearing reconciliation.

Collaborating to create

industry standard tools

Through partnership with the clearing and trading community, as well as clients and regulators, we deliver targeted advocacy and technological innovations that can drive greater market efficiencies. Every service is designed to benefit all market participants. Our industry-scale brokerage platform connects all major exchanges and processes 80% of daily global brokerage transactions.

Our Offerings

Documentation

Our platform provides tools for streamlining and processing agreements & contracts, enables users to cut costs and free up staff time, improve workflow processes for establishing trading relationships, and enhance security and data protection.

Brokerage Processing

We have the tools you need to manage the entire payables and receivables lifecycle quickly and easily through our Accelerate platform. We connect you to all market participants — exchanges, brokers, clearers and clients, for end-to-end management of brokerage relationships, payments, settlement and reconciliation.

The FIA Tech Platform

- Compliance and Reporting with Owner Controller Repository

- Golden Source Reference Data with Databank

- Legal Documentation and Rate Schedule management with Docs

Global 24/6 Support

London

London Office:

2 Eastbourne Terrace, London W2 6LG

United Kingdom

New York

NY Office

1450 Broadway, 12th floor, New York, NY, 10018

Tampa

Tampa

Tampa Office:

Washington DC

Washington D.C Office:

2001 K Street, NW,

Suite 730 |

Washington, D.C,

20006-1071

Contact Us

General

For general inquiries regarding Accelerate:

Call: +1-202-772-3000

Email General Client Support: clientservices@fia-tech.com

Atlantis

General inquiries regarding Atlantis

Call: +1-202-772-3000

Docs

OCR

eRecs

General inquiries regarding eRecs

Call: +1-202-772-3000

Databank

General inquiries regarding Databank

Call: +1-202-772-3000

General

For general inquiries regarding Accelerate:

Call: +1-202-772-3000

Email General Client Support: clientservices@fia-tech.com

Atlantis

General inquiries regarding Atlantis

Call: +1-202-772-3000

Docs

OCR

eRecs

General inquiries regarding eRecs

Call: +1-202-772-3000

Databank

General inquiries regarding Databank

Call: +1-202-772-3000